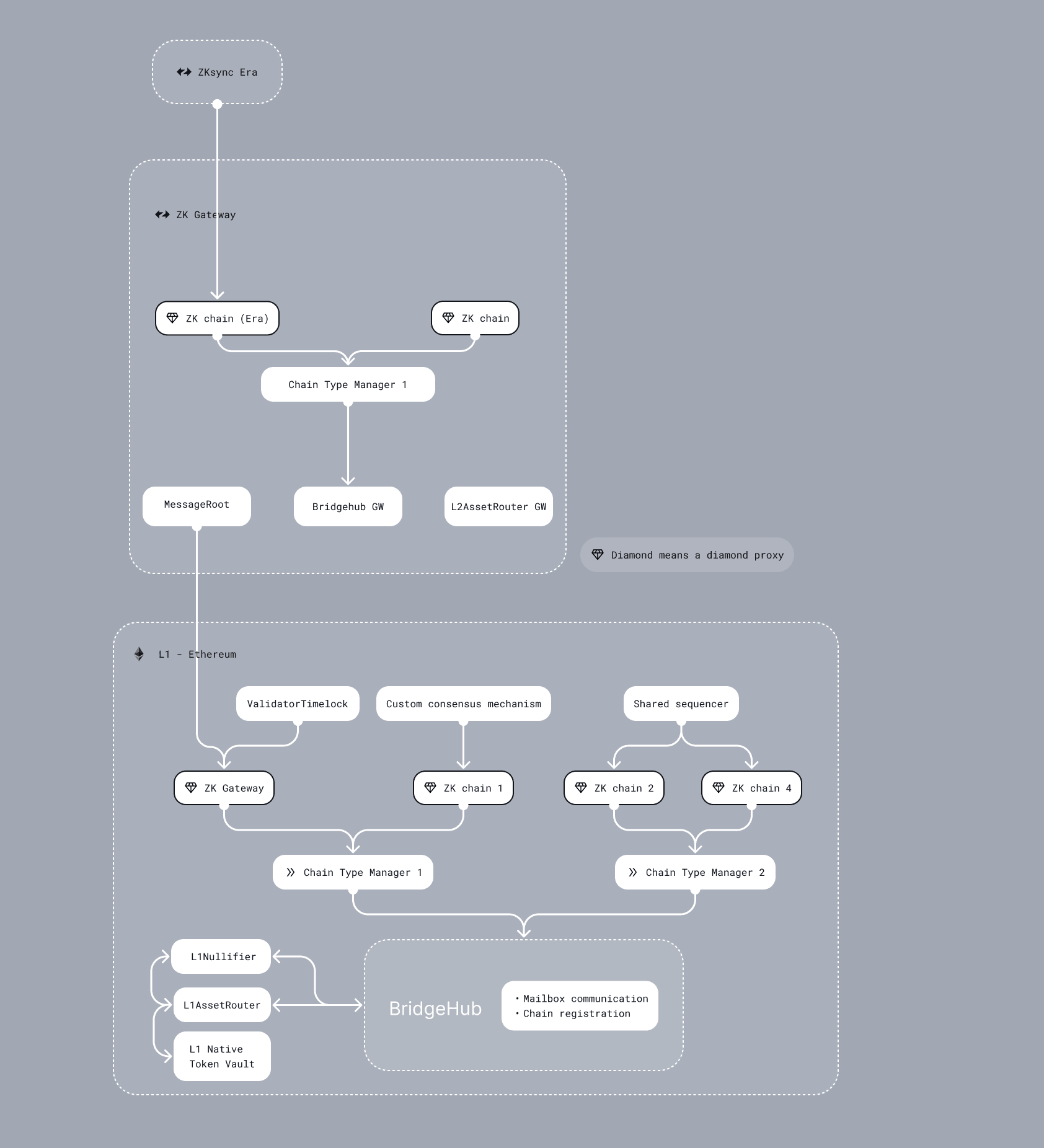

L1 ecosystem contracts

Ethereum's future is rollup-centric. This means moving beyond isolated EVM chains toward an infrastructure centered around an ecosystem of interconnected ZKsync Chains. These chains are independently deployed rollups or validiums built using the ZK Stack, and together they form a coordinated network secured by Ethereum.

To support this ecosystem, Ethereum requires shared Layer 1 smart contracts. This page outlines the ZK Stack’s approach to these contracts: their interfaces, architectural changes, and future features to enable cross-chain functionality, shared liquidity, and interoperability.

If you're new to ZKsync Chains, see our Introduction to ZKsync Chains. This document assumes you're already familiar with rollups, ZKsync chains, and references ZKsync Era as an example implementation.

Long term goal

We want to create a system where:

- ZKsync Chains should be launched permissionless-ly within the ecosystem.

- ZK-powered bridges should enable unified liquidity for assets across the ecosystem.

- Multi-chain smart contracts need to be easy to develop, which means easy access to traditional bridges, and other supporting architecture.

ZKsync Chain & CTM

ZKsync Chain (Diamond Proxy)

A high-level recap on how zk rollups work:

- Offchain operators collect transactions, process those and submit a tuple of

(old_state, new_state, proof)to the L1 contract. - The L1 contract then verifies that the proof is correct.

If the proof is indeed correct, the

new_stategets saved on the L1 contract. Thisnew_statemay not only include the storage root, but also a tree for L2→L1 messages (which allow to conduct withdrawals of funds from the L2), etc.

In other words, we can imagine the L1 part of each rollup as basically a “state transition function verifier”, the only role of which is to check whether the state transition proposed by the operator of the chain is correct.

To not commit to a specific type or option of this "state transition function”, we’ll call each rollup a ZKsync Chain (note, that these can also be Validiums). Since protocol upgrade v24 (May 2024), all ZKsync Chain contracts, including ZKsync Era diamond proxy, no longer directly manages any funds.

Instead, this responsibility transitions to the shared bridge. This document describes technical details of ZK Stack contracts that make it possible for multiple chains to share liquidity, and provide cost-effective communication among them. Before delving into the details of ecosystem contracts, please familiarize yourself with the concept of ZKsync Chains and read the L1 smart contracts page for a better understanding of single instance ZKsync Chain.

Chain Type Manager (CTM)

Currently bridging between different zk rollups requires the funds to pass through L1. This is slow & expensive.

The vision of seamless internet of value requires transfers of value to be both seamless and trustless. This means that for instance different ZKsync Chains need to share the same L1 liquidity, i.e. a transfer of funds should never touch L1 in the process. However, it requires some sort of trust between two chains. If a malicious (or broken) rollup becomes a part of the shared liquidity pool it can steal all the funds.

However, can two instances of the same zk rollup trust each other? The answer is yes, because no new additions of rollups introduce new trust assumptions. Assuming there are no bugs in circuits, the system will work as intended.

How can two rollups know that they are two different instances of the same system? We can create a factory of such contracts (and so we would know that each new rollup created by this instance is correct one). But just creating correct contracts is not enough. Ethereum changes, new bugs may be found in the original system and so an instance that does not keep itself up-to-date with the upgrades may exploit some bug from the past and jeopardize the entire system. Just deploying is not enough. We need to constantly make sure that all ZKsync Chains are up to date and maintain whatever other invariants are needed for these ZKsync Chains to trust each other.

Let’s define as Chain Type Manager (CTM) **as a contract that is responsible for the following:

- It serves as a factory to deploy ZKsync Chains

- It is responsible for ensuring that all the ZKsync Chains deployed by it are up-to-date.

Note, that this means that ZKsync Chains have a “weaker” governance. I.e. governance can only do very limited number of things, such as setting the validator. A ZKsync Chain governor can not set its own upgrades and it can only “execute” the upgrade that has already been prepared by the CTM.

In the long term vision ZKsync Chains deployment will be permissionless, however CTM will always remain the main point of trust and will have to be explicitly whitelisted by the greater governance of the entire ZKsync ecosystem before a ZKsync Chain gets access to the shared liquidity.

Configurability in the first release

For now, only one CTM will be supported — the one that deploys instances of ZKsync Chains, possibly using other DA layers. The inner working of different DA layer support is not relevant for this documentation.

The exact process of deploying & registering a ZKsync Chain will be described in sections below.

Overall, each ZKsync Chain in the first release will have the following parameters:

| ZKsync Chain parameter | Updateability | Comment |

|---|---|---|

| chainId | Permanent | Permanent identifier of the ZKsync Chain. Due to wallet support reasons, for now chainId has to be small (48 bits). This is one of the reasons why for now we’ll deploy ZKsync Chains manually, to prevent ZKsync Chains from having the same chainId as some another popular chain. In the future it will be trustless-ly assigned as a random 32-byte value. |

| baseToken | Permanent | Each ZKsync Chain can have their own custom base token (i.e. token used for paying the fees). It is set once during creation and can never be changed. For now, each baseToken has to be backed by the corresponding L1 tokens. The requirements for the baseToken will be explored in the sections dedicated to SharedBridge. |

| baseTokenBridge | Permanent | The L1 shared bridge address. Used to transfer ETH from ERA chain to shared bridge, finalizing withdrawal and requesting an L2 transaction from the ERA chain |

| chainTypeManager | Permanent | The CTM that deployed the ZKsync Chain. In principle, it could be possible to migrate between CTMs (assuming both CTMs support that). However, in practice it may be very hard and as of now such functionality is not supported. |

| admin | By admin of ZKsync Chain | The governor of the ZKsync Chain has some limited powers to govern the chain |

| validatorTimelock | CTM | For now, we want all the chains to use the same 21h timelock period before their batches are finalized. Only CTM can update the address that can submit state transitions to the rollup (that is, the validatorTimelock). |

| validatorTimelock.validator | CTM | The governance of a ZKsync Chain can choose who can submit new batches to the ValidatorTimelock. |

| priorityTx Validation/ priorityTx FeeParams | CTM | For now, for the additional security only CTM can define the validation rules for L1→L2 transactions coming to the chain. |

| executing upgrades | By governance of a ZKsync Chain or CTM | While exclusively CTM governance can set the content of the upgrade, ZKsync Chains will typically be able to choose a suitable time for them to actually execute it. In the first release, ZKsync Chains have to follow our upgrades. |

However, in case of urgent high risk situation, CTM might force upgrade the contract.

It is also planned to allow different chains different L1→L2 tx validation methods. This might be helpful for some chains that want to put heavier restrictions on the L1→L2 transactions coming from L1.

Upgradability in the first release

In the first release, each chain will be an instance of ZKsync Era and so the upgrade process of each individual ZKsync Chain will be similar to that of ZKsync Era.

- Firstly, the governance of the CTM will publish the server (including sequencer, prover, etc) that support the new version . This is done offchain. Enough time should be given to various ZK Stack devs to update their version.

- The governance of the CTM will schedule the upgrade. This operation also notifies the operators of ZKsync Chains on when they should start processing new batches. The server is written in such a way that automatically at the scheduled timestamp of the upgrade the new version will be used in batches. If the timestamp is set in the past, the new version will be used immediately.

- After the timestamp has passed it is expected that ZK Stack instances will all start processing the new version on the server side.

After that the governance atomically calls the following three functions:setInitialCutHash⇒ to ensure that new chains will be created with the versionsetValidatorTimelock(if needed) ⇒ to ensure that the new chains will use the new validator timelock right-awaysetNewVersionUpgrade⇒ to save the upgrade information that each ZKsync Chain will need to follow to conduct the upgrade on their side.

- After this step, the batches with the old protocol version can no longer be committed. They can be proved & executed however.

Emergency upgrade

In case of an emergency of a critical bug, the step (1) can be skipped as well as the waiting period in step (2) can be reduced to 0.

In case we are aware that some of the committed batches on a ZKsync

Chain are dangerous to be executed, the CTM can call revertBatches on that ZKsync Chain.

Issues & caveats

- If a ZKsync Chain skips an upgrade

(i.e. it has version X, it did not upgrade to

X + 1and now the latest protocol version isX + 2there is no built-in way to upgrade). This team will require manual intervention from us to upgrade. - The upgrades of ZKsync Chains are not fully async as of now (i.e. either tight coordination or strict deadlines are required to ensure that every ZKsync Chain has time to commit their batches). This needs to be fixed in the future releases.

- The approach of calling

revertBatchesfor malicious ZKsync Chains is not scalable (O(N) of the number of chains). The situation is very rare, so it is fine in the short term, but not in the long run.

BridgeHub & Shared Bridge

In the previous section we discussed how ZKsync Chains and CTMs work. However, these are just means to get the collection of chains that can trust each other, while providing robust customize-ability for each individual chain.

In this section we’ll explore how exactly unified liquidity is achieved and how ZKsync Chains get deployed.

Creating new chains with BridgeHub

The main contract of the whole ZKsync Chain ecosystem is called BridgeHub. It contains:

- the registry from chainId to CTMs that is responsible for that chainId

- the base token for each chainId.

- the whitelist of CTMs

- the whitelist of tokens allowed to be

baseTokensof chains.

In the long run, any baseToken could be used (potentially at the peril of the ZKsync Chain that decides to use it).

It will also be possible to add multiple CTMs.

BridgeHub is responsible for creating new ZKsync Chains. It is also the main point of entry for L1→L2 transactions for all the ZKsync Chains. Users won't be able to interact with ZKsync Chains directly, all the actions must be done through the BridgeHub, which will ensure that the fees have been paid and will route the call to the corresponding ZKsync Chain. One of the reasons it was done this way was to have the unified interface for all ZKsync Chains that will ever be included in the ZKsync Chain ecosystem.

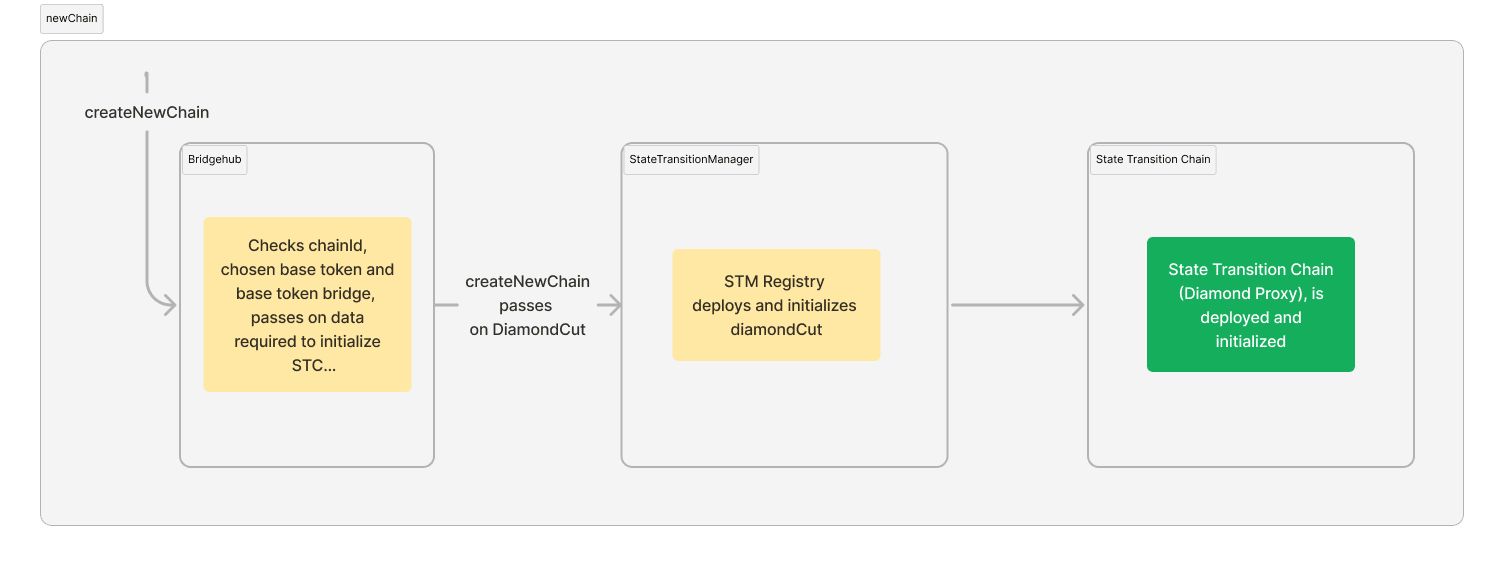

To create a chain, the BridgeHub.createNewChain function needs to be called:

function createNewChain(

// The expected chainId of the new ZKsync Chain

uint256 _chainId,

// The chain type manager that will deploy & manage it

address _chainTypeManager,

// The baseToken to be used by the ZKsync Chain

address _baseToken,

// Salt, for now it is not used. It will be used in the future for

// random chainId generation

uint256, //_salt

// The initial admin of the ZKsync Chain

address _admin,

// The initData. This data is strictly defined by CTM and is needed to initialize

// the ZKsync Chain with the latest protocol version. The correctness of it will be verified by CTM.

bytes calldata _initData

)

BridgeHub will check that the CTM as well as the base token are whitelisted and route the call to the State

Creation of a chain in the first release

In the future, ZKsync Chain creation will be permissionless.

A securely random chainId will be generated for each chain to be registered.

However, generating 32-byte chainId is not feasible with the current SDK expectations on EVM and so for now chainId is of type uint48.

And so it has to be chosen by the governance of BridgeHub.

Also, for the first release we would want to avoid chains being able to choose their own initialization parameter to prevent possible malicious input.

For this reason, there will be an entity called admin which is basically a hot key managed by the

ZKsync team and it will be used to deploy new ZKsync Chains.

So the flow for deploying their own ZKsync Chain for users will be the following:

- Users contact the ZKsync team (e.g. via a Google Form) about deploying a ZKsync Chain with certain governance, CTM (we’ll likely allow only one for now), and baseToken.

- Our server will generate a chainId not reserved by any other major chain and the

adminwill call theBridgeHub.createNewChain. This will call theCTM.createNewChainthat will deploy the instance of the rollup as well as initialize the first transaction there — the system upgrade transaction needed to set the chainId on L2.

After that, the ZKsync Chain is ready to be used.

SharedBridge as store of base tokens

For liquidity to be unified there needs to be a contract that actually maintains all of it.

This contract is SharedBridge. Users are free to deploy their own bridges to interact with the ZKsync Chain ecosystem,

but SharedBridge is special, because it maintains the balance of all the baseTokens, including all of ETH supply.

In the future we might allow multiple base token bridges, or we will make the current shared bridge more customizable.

Handling base tokens

On L2, a base token (not to be consfused with a native token, i.e. an ERC20 token with a main contract on the chain)

is the one that is used for msg.value and it is managed at L2BaseToken system contract.

We need its logic to be strictly defined in L2BaseToken,

since the base asset is expected to behave the exactly the same as ether on EVM.

For now this token contract does not support base minting and burning of the asset, nor further customization.

In other words, in the current release base assets can only be transferred through msg.value.

They can also only be minted when they are backed 1-1 on L1.

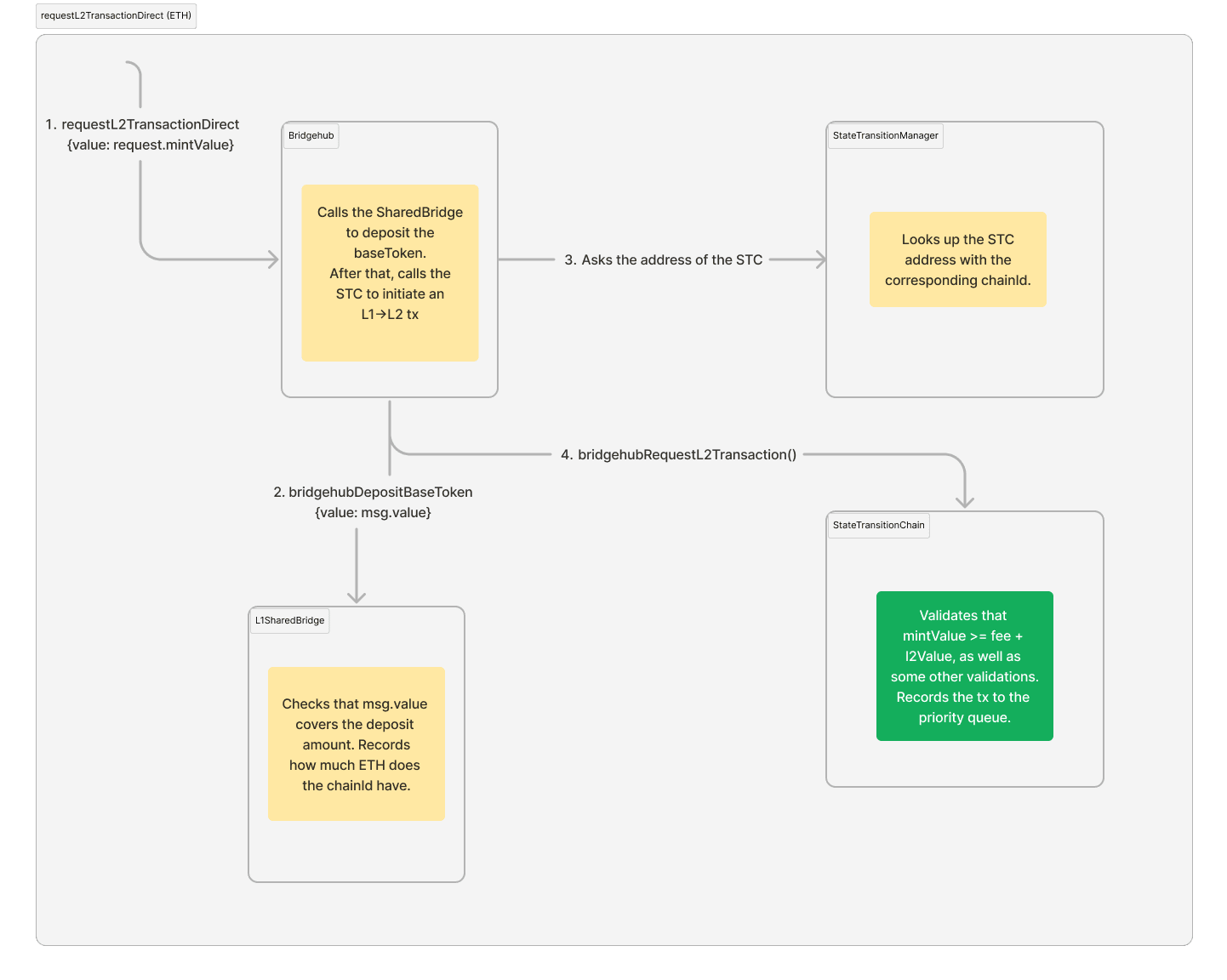

L1→L2 communication

L1→L2 communication allows users on L1 to create a request for a transaction to happen on L2. This is the primary censorship resistance mechanism. If you are interested, you can read more on L1→L2 communications here, but for now just understanding that L1→L2 communication allows to request transactions to happen on L2 is enough.

The L1→L2 communication is also the only way to mint a base asset at the moment.

Fees to the operator as well as msg.value will be minted on L2BaseToken after the corresponding L1→L2 tx has been processed.

To request an L1→L2 transaction, the BridgeHub.requestL2TransactionDirect function needs to be invoked.

The user should pass the struct with the following parameters:

struct L2TransactionRequestDirect {

uint256 chainId;

uint256 mintValue;

address l2Contract;

uint256 l2Value;

bytes l2Calldata;

uint256 l2GasLimit;

uint256 l2GasPerPubdataByteLimit;

bytes[] factoryDeps;

address refundRecipient;

}

Most of the params are self-explanatory & replicate the logic of ZKsync Era. The only new fields are:

mintValueis the total amount of the base tokens that should be minted on L2 as the result of this transaction. The requirement is thatrequest.mintValue >= request.l2Value + request.l2GasLimit * derivedL2GasPrice(...), wherederivedL2GasPrice(...)is the gas price to be used by this L1→L2 transaction. The exact price is defined by the ZKsync Chain.

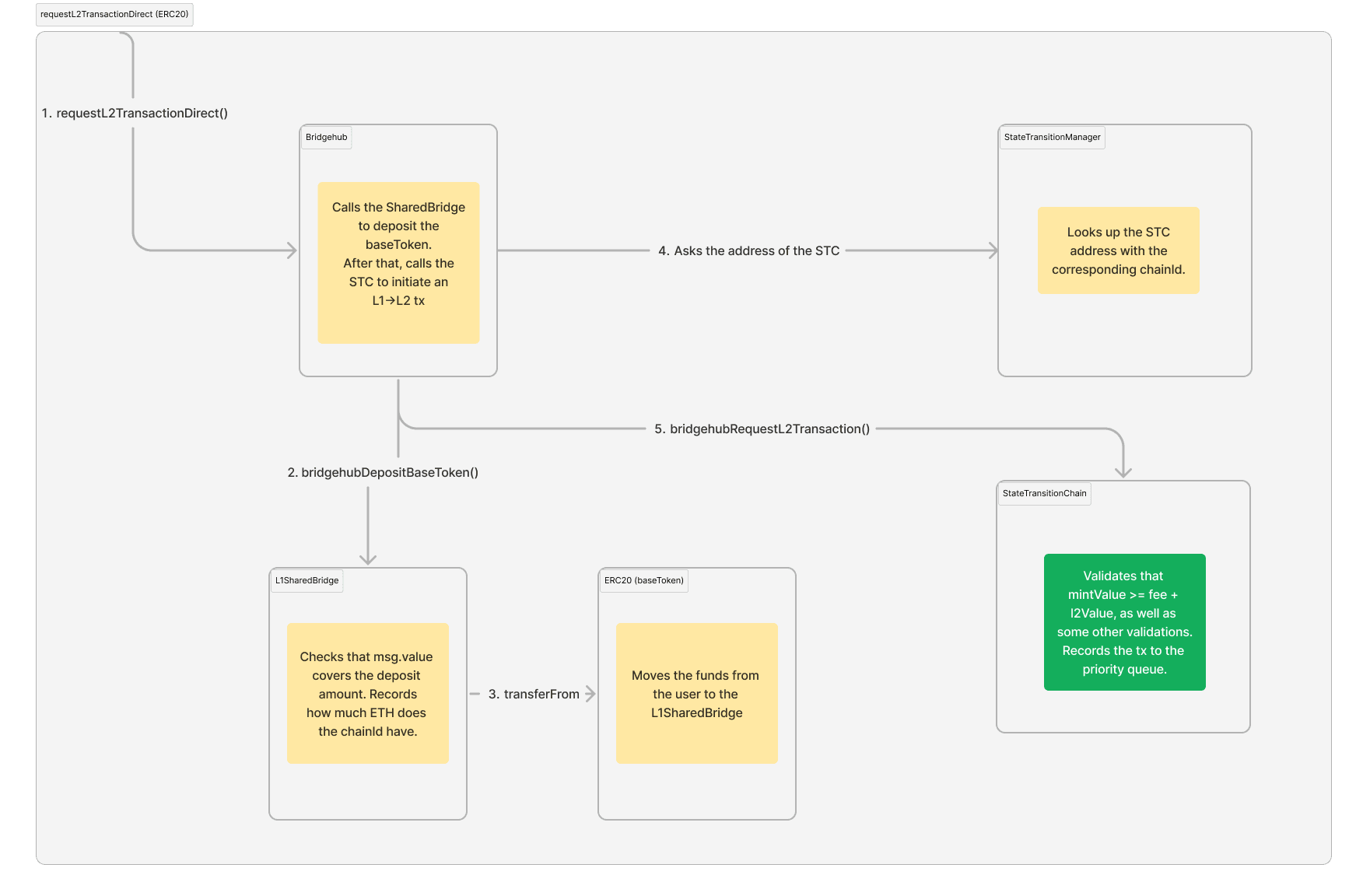

Here is a quick guide on how this transaction is routed through the bridgehub.

- The bridgehub retrieves the

baseTokenof the chain with the correspondingchainIdand depositsmintValuetokens to the SharedBridge. In case the baseToken is ETH, it must be provided with themsg.valueof the L1 transaction. If the base token is an ERC20, the corresponding allowance should be provided beforehand to the SharedBridge.

This step ensures that the baseToken will be backed 1-1 on L1. - After that, it just routes the corresponding call to the ZKsync Chain with the corresponding

chainId. It is now the responsibility of the ZKsync Chain to validate that the transaction is correct and can be accepted by it. This validation includes, but not limited to:- The fact that the user paid enough funds for the transaction (basically

request.l2GasLimit * derivedL2GasPrice(...) + request.l2Value >= request.mintValue. - The fact the transaction is always executable (the

request.l2GasLimitis not high enough). - etc.

- The fact that the user paid enough funds for the transaction (basically

- After the ZKsync Chain validates the tx, it's included into its priority queue.

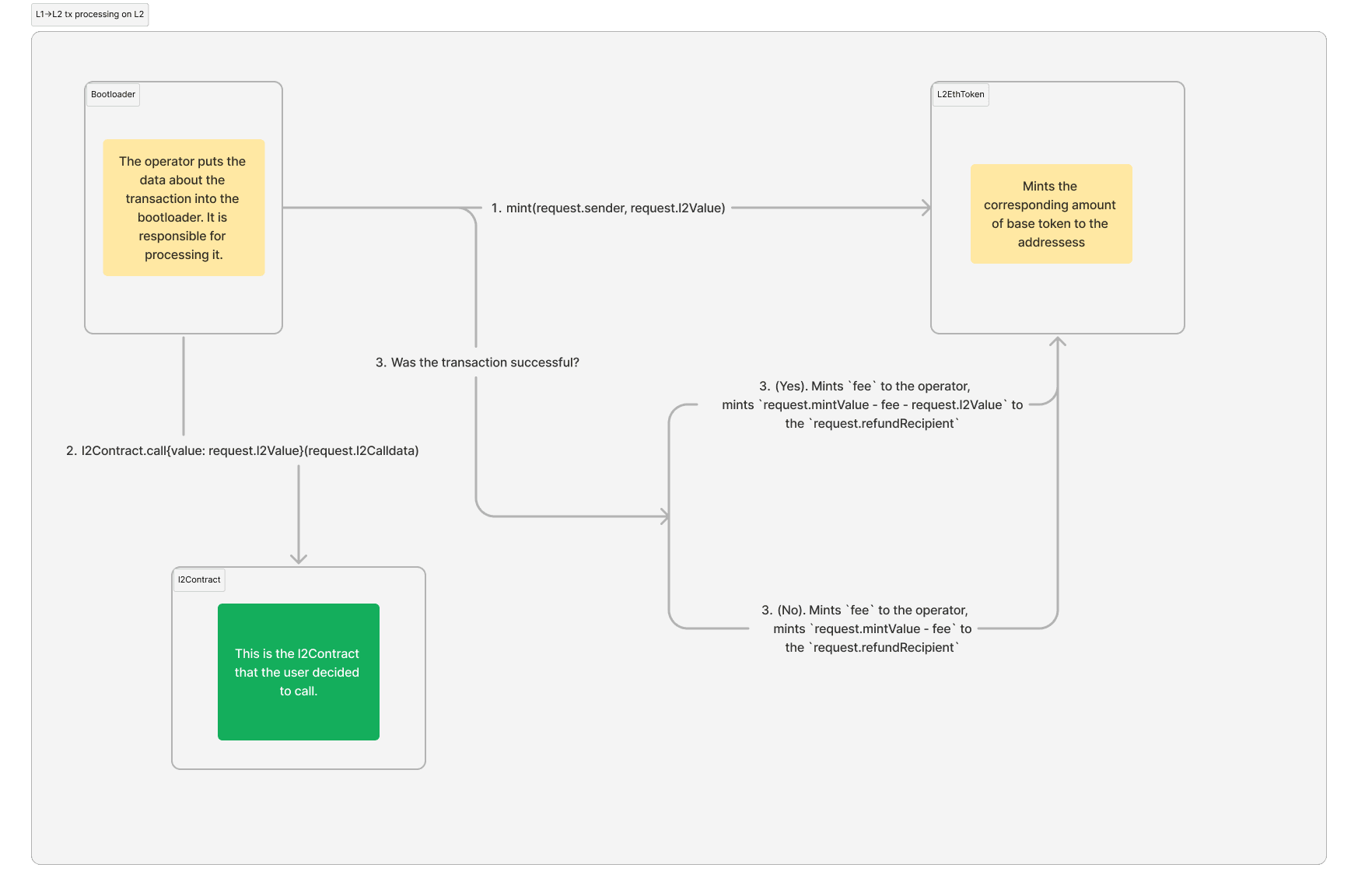

Once the operator executes this transaction on L2, the

mintValueof the baseToken will be minted on L2. ThederivedL2GasPrice(...) * gasUsedwill be given to the operator’s balance. The other funds can be routed either of the following way:

If the transaction is successful, the request.l2Value

will be minted on the request.l2Contract address (it can potentially transfer these funds within the transaction).

The rest are minted to the request.refundRecipient address.

In case the transaction is not successful, all of the base token will be minted to the request.refundRecipient address.

These are the same rules as for the ZKsync Era.

Diagram of the L1→L2 transaction flow on L1 when the baseToken is ETH:

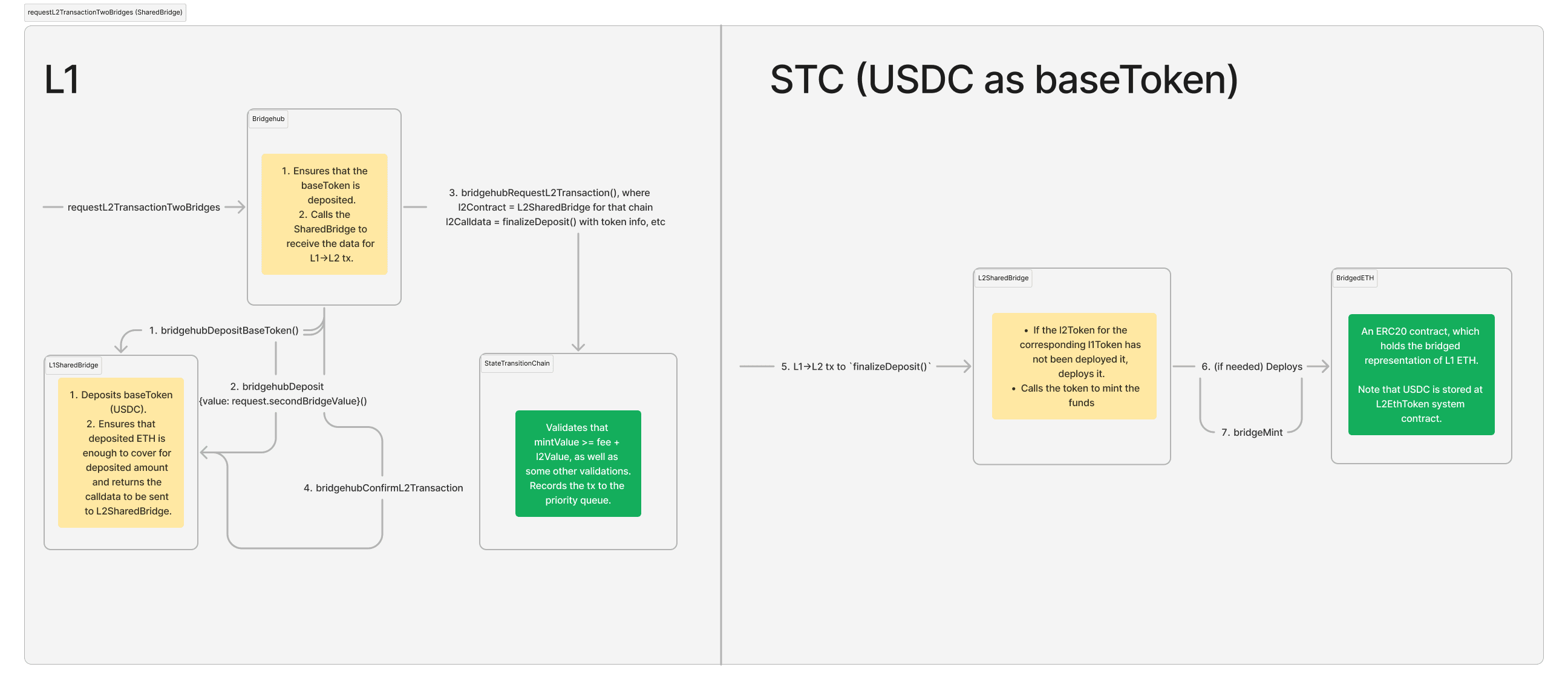

Diagram of the L1→L2 transaction flow on L1 when the baseToken is an ERC20:

Diagram of the L1→L2 transaction flow on L2 (it is the same regardless of the baseToken):

Limitations of custom base tokens in the first release

ZKsync Chains use ETH as a base token by default.

Upon creation of a ZKsync Chain, chain operators may want to use their own custom base tokens.

Note, that for the first release all the possible base tokens are whitelisted.

The other limitation is that all the base tokens must be backed 1-1 on L1 as well as they are solely implemented with L2BaseToken contract.

In other words:

- No custom logic is allowed on L2 for base tokens

- Base tokens can not be minted on L2 without being backed by the corresponding L1 amount.

If someone wants to build a protocol that mints base tokens on L2, the option for now is to “mint” an infinite amount of those on L1, deposit on L2 and then give those out as a way to “mint”. We will update this in the future.

General architecture and initialization of SharedBridge for a new ZKsync Chain

Right after a ZKsync Chain is deployed, the SharedBridge will already be used for baseToken-related bridging.

However, it can also support the ERC20 bridging.

But for that it needs additional components.

The SharedBridge consists of two parts:

L1SharedBridgethat stores all the funds on L1.L2SharedBridgethat mints & manages the corresponding tokens on L2. Also, whenever a withdrawal needs to happen, the user calls this asset

L1SharedBridge contains a mapping from a chainId to the address of the L2SharedBridge.

Whenever a deposit to certain chain happens L1SharedBridge looks up the address of the L2SharedBridge and asks to do an L1→L2 transaction there.

Note, that it is actually vital that the corresponding L2 counterpart is

already pre-deployed before the bridge serves its first non-basetoken deposit.

If this is not the case, the deposits will “fail” in the sense that no tokens on L2 will be minted,

while the status of the transaction will be “success” (since an empty address was called)

meaning that there is no way for users to reclaim those funds.

The flow is expected to be the following:

- Once a ZKsync Chain is created, it will be the job of its first validator (it can be done any user with access to that ZKsync Chain) to deploy such a bridge.

- Before

SharedBridgecan start depositing non-base tokens to that bridge, someone must provide a proof that indeed such a contract has been deployed on a certain specific address. After that the correspondingL2SharedBridgelocation for suchchainIdwill be stored.

The details of how such a proof should look like are out of the scope of this document, but it is relatively easy to do.

Initialization in the first release

In the first release however, instead of providing such a proof permissionless-ly on L1,

the ZKsync Chain owner will have to send a message to us, we will double-check that the deployed bytecode is correct and initialized properly.

Once it is done, our governance will call the initializeChainGovernance function on the SharedBridge to make a chain as initialized.

Shared bridge as standard ERC20 bridge

SharedBridge does not only serve as store for base tokens.

It is also the de-facto ZKsync Chain implementation of the ZKsync ERC20 token

default bridge,

i.e. the bridge that allows users to bridge ERC20 assets to the L2.

The bridged assets will have “standard” ERC20 token implementation, i.e. fee-on-transfer,

rebase or other sort of custom token functionality will not be supported for bridged assets.

For a better understanding of this section it is recommended to read about how bridging on ZKsync Chains works.

Let’s say that a ZKsync Chain has ETH as its base token.

Let’s say that the depositor wants to bridge USDC to that chain.

We can not use BridgeHub.requestL2TransactionDirect, because it only takes base token mintValue

and then starts an L1→L2 transaction rightaway out of the name of the user and not the L1SharedBridge.

We need some way to atomically deposit both ETH and USDC to the shared bridge + start a transaction from L1SharedBridge.

For that we have a separate function on Bridgehub: BridgeHub.requestL2TransactionTwoBridges.

The reason behind the name “two bridges” will be explored a bit later,

but for now let’s only take the case for trying to deposit a non-base token via SharedBridge.

When calling BridgeHub.requestL2TransactionTwoBridges the following struct needs to be provided:

struct L2TransactionRequestTwoBridgesOuter {

uint256 chainId;

uint256 mintValue;

uint256 l2Value;

uint256 l2GasLimit;

uint256 l2GasPerPubdataByteLimit;

address refundRecipient;

address secondBridgeAddress;

uint256 secondBridgeValue;

bytes secondBridgeCalldata;

}

The first few fields are the same as for the simple L1→L2 transaction case. However there are three new fields:

secondBridgeAddressis the address of the bridge which is responsible for the asset being deposited. In this case it should be the sameSharedBridgesecondBridgeValueis themsg.valueto be sent to the bridge which is responsible for the asset being deposited (in this case it isSharedBridge). This can be used to deposit ETH to ZKsync Chains that have a base token that is not ETH.secondBridgeCalldatais the data to pass to the bridge.SharedBridgerequires it to beabi.encode(address _l1Token, uint256 _depositAmount, address _l2Receiver), where this is the data about which L1 token to deposit to L2, the amount to deposit, and where should it go.

The function will do the following:

L1

- It will deposit the

request.mintValueof the ST’s base token the same way as during a simple L1→L2 transaction. These funds will be used for funding thel2Valueand the fee to the operator. - It will call the

secondBridgeAddress(SharedBridge) once again and this time it will deposit the funds to theSharedBridge, but this time it will be deposit not to pay the fees, but rather_depositAmountof_l1Tokenwill be deposited.

This call will return the parameters to call the l2 contract with (the address of the L2 bridge counterpart, the calldata and factory deps to call it with). - After the BridgeHub will call the ZKsync Chain to add the corresponding L1→L2 transaction to the priority queue.

- The BridgeHub will call the

SharedBridgeonce again so that it can remember the hash of the corresponding deposit transaction. This is needed in case the deposit fails.

L2

- After some time, the corresponding L1→L2 is created.

- The L2 bridge counterpart will deploy the standard L2 token implementation for this specific asset if it has not been deployed previously.

- The L2 bridge counterpart will mint the funds.

Diagram of a depositing ETH onto a chain with USDC as the baseToken.Note that some contract calls (like USDC.transferFrom are omitted for the sake of consiceness):

Generic usage of BridgeHub.requestL2TransactionTwoBridges

SharedBridge is the only bridge that can handle base tokens.

However, anyone is allowed to create any sort of bridge that handle non-base assets.

For bridging tokens via such bridges, the same BridgeHub.requestL2TransactionTwoBridges has to be used.

Let’s do a quick recap on how it works:

When calling BridgeHub.requestL2TransactionTwoBridges the following struct needs to be provided:

struct L2TransactionRequestTwoBridgesOuter {

uint256 chainId;

uint256 mintValue;

uint256 l2Value;

uint256 l2GasLimit;

uint256 l2GasPerPubdataByteLimit;

address refundRecipient;

address secondBridgeAddress;

uint256 secondBridgeValue;

bytes secondBridgeCalldata;

}

secondBridgeAddressis the address of the bridge that is responsible for the asset being deposited.secondBridgeValueis themsg.valueto be sent to the bridge which is responsible for the asset being deposited.secondBridgeCalldatais the data to pass to the bridge. This can be interpreted any way it wants.

- Firstly, It will deposit the

request.mintValuethe same way as during a simple L1→L2 transaction. These funds will be used for funding thel2Valueand the fee to the operator. - After that, the

secondBridgeAddress.bridgehubDepositwith the following signature is called

struct L2TransactionRequestTwoBridgesInner {

// Should be equal to a constant `keccak256("TWO_BRIDGES_MAGIC_VALUE")) - 1`

bytes32 magicValue;

// The L2 contract to call

address l2Contract;

// The calldata to call it with

bytes l2Calldata;

// The factory deps to call it with

bytes[] factoryDeps;

// Just some 32-byte value that can be used for later processing

// It is called `txDataHash` as it *should* be used as a way to facilitate

// reclaiming failed deposits.

bytes32 txDataHash;

}

function bridgehubDeposit(

uint256 _chainId,

// The actual user that does the deposit

address _prevMsgSender,

// The msg.value of the L1->L2 transaction to be created

uint256 _l2Value,

// Custom bridge-specific data

bytes calldata _data

) external payable returns (L2TransactionRequestTwoBridgesInner memory request);

Now the job of the contract will be to “validate” whether they are okay with the transaction to come.

For instance, if it is some sort of “WETH” bridge,

it would check that msg.value is enough to cover for the minted L2 WETH.

Another potential functionality of this part is to deposit the corresponding L1 assets to the contracts.

Both of the things above are done by the SharedBridge.

However, a custom bridge can be whatever it wants.

Ultimately, the correctly processed bridgehubDeposit function basically grants BridgeHub

the right to create an L1→L2 transaction out of the name of the secondBridgeAddress.

Since it is so powerful, the first returned value must be a magical constant that is equal to keccak256("TWO_BRIDGES_MAGIC_VALUE")) - 1.

The fact that it was a somewhat non standard signature and a struct with the magical value is the major defense

against “accidental” approvals to start a transaction out of the name of an account.

Aside from the magical constant, the method should also return the information an L1→L2 transaction will start its call with:

the l2Contract , l2Calldata, factoryDeps.

It also should return the txDataHash field.

The meaning txDataHash will be needed in the next paragraphs.

But generally it can be any 32-byte value the bridge wants.

- After that, an L1→L2 transaction is invoked.

Note, that the “trusted”

SharedBridgehas enforced that the baseToken was deposited correctly (again, the step (1) can only be handled by theSharedBridge), while the second bridge can provide any data to call its L2 counterpart with. - As a final step, following function is called:

function bridgehubConfirmL2Transaction(

// `chainId` of the ZKsync Chain

uint256 _chainId,

// the same value that was returned by `bridgehubDeposit`

bytes32 _txDataHash,

// the hash of the L1->L2 transaction

bytes32 _txHash

) external;

This function is needed for whatever actions are needed to be done after the L1→L2 transaction has been invoked.

On SharedBridge it is used to remember the hash of each deposit transaction,

so that later on, the funds could be returned to user if the L1->L2 transaction fails.

The _txDataHash is stored so that the whenever the users will want to reclaim funds from a failed deposit,

they would provide the token and the amount as well as the sender to send the money to.

The call diagram for an L1 generic deposit via

requestL2TransactionTwoBridges& a custom bridge looks the same as with theSharedBridge. Ultimately the L2 behavior depends on the implementation of the custom bridge, i.e. whichl2Contractandl2Calldatait will return inbridgehubDeposit.

Claiming failed deposits

In case a deposit fails, the SharedBridge allows users to recover the deposited funds

by providing a proof that the corresponding transaction indeed failed.

The logic is the same as in the current Era implementation. The legacy bridge routes the transactions to claim failed deposits to SharedBridge now

Withdrawing funds from L2

Funds withdrawal is done the same way as it is currently on Era. The only difference is that now wrapped tokens are supported as well.

The user needs to call the L2SharedBridge.withdraw function on L2, while providing the token they want to withdraw.

This function works both for the wrapped base token and for any standard bridged ERC20.

Note, however, that it is not the way to withdraw base token.

To withdraw base token, L2BaseToken.withdraw needs to be called.

After the batch with the withdrawal request has been executed,

the user can finalize the withdrawal on L1 by calling L1SharedBridge.finalizeWithdrawal,

where the user provides the proof of the corresponding withdrawal message.

Migration of ZKsync Era

All of the above describes how the shared bridge & bridge hub will work in the end. However, how do we make sure that the users’ interfaces don't break? ZKsync Era was the first chain to migrate to the shared bridge and BridgeHub. The following steps were required.

Migrating bridges

L1ERC20Bridge was migrated to a new implementation that routes all calls to the L1SharedBridge.

Also we migrated all ERC20 balances to the new L1SharedBridge.

At the time a total of 246 tokens were migrated.

L2ERC20Bridge already has the needed interfaces and so it was just migrated to become L2SharedBridge directly.

Also, right now it is possible to derive on L1 the address of the corresponding bridged L2 token.

This will not be possible as in theory different ZKsync Chains might have different code for deployed beacon proxy.

This functionality will only be maintained for backwards compatibility in L1ERC20Bridge that can only interact with ZKsync Era.

Migrating direct interaction with ZKsync Era

ZKsync Era became a ZKsync Chain under a newly deployed CTM. However, users already rely on the fact that it is possible to interact with ZKsync Era directly and not through BridgeHub. We will keep that functionality exclusively for ZKsync Era for backwards compatibility.

In practice, all our ZKsync Chains will have Era’ requestL2Transaction function,

but it will be only allowed to be called if the ZKsync Chain is actually ZKsync Era.

Also, during migration ZKsync Era transferred all its ETH to BridgeHub.

Additional limitations for the first release

In the first release creating new chains as well as SharedBridge initialization for new chains will not be permissionless.

That is needed to ensure that no malicious input can be provided there.

Also, since in the first release, there will be little benefits from shared liquidity, i.e. the there will be no direct Chain<>Chain transfers supported, as a measure of additional security we’ll also keep track of balances for each individual ZKsync Chain and will not allow it to withdraw more than it has deposited into the system.

Other contracts

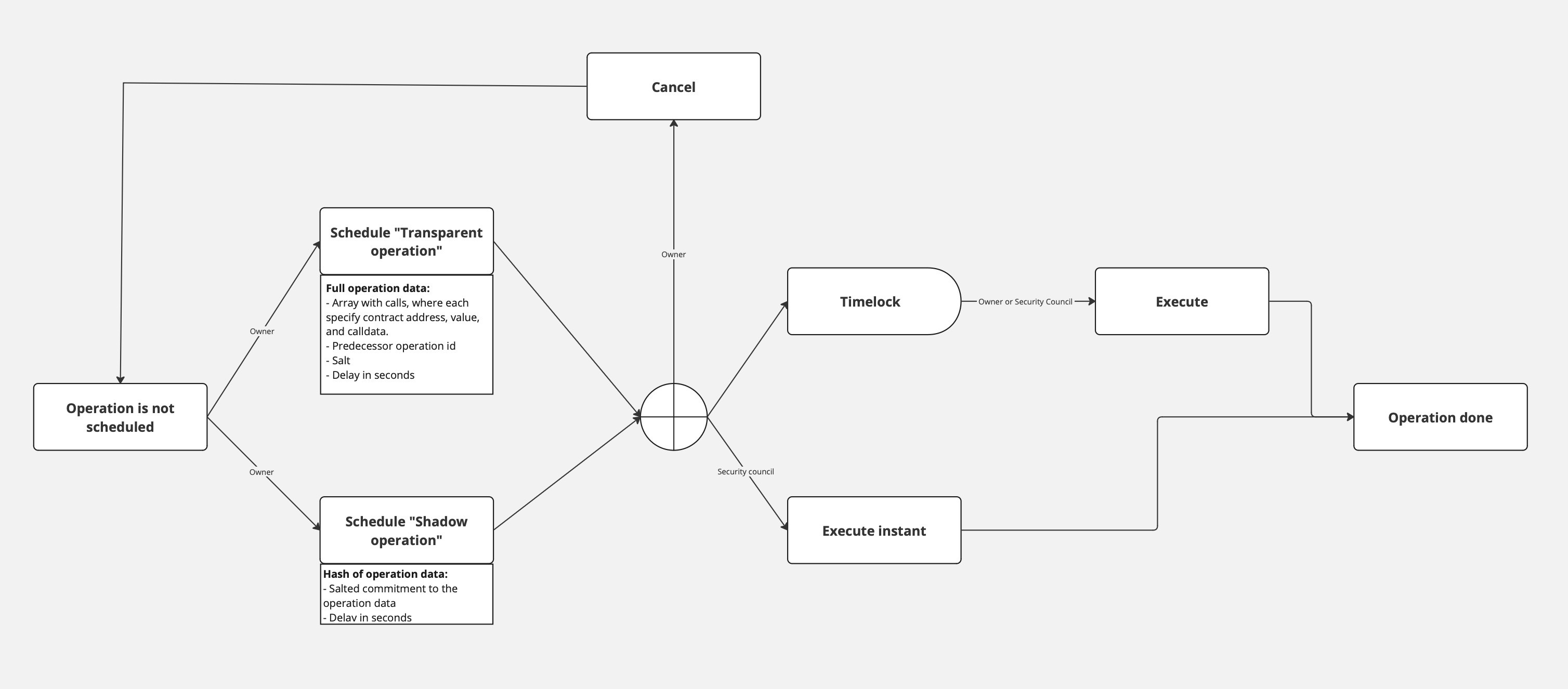

Governance

This contract manages calls for all governed ZKsync Chain contracts on L1 and L2. Mostly, it is used for upgradeability and changing critical system parameters. The contract has minimum delay settings for the call execution.

Each upgrade consists of two steps:

- Scheduling - The owner can schedule upgrades in two different manners:

- Fully transparent data. All the targets, calldata, and upgrade conditions are known to the community before upgrade execution.

- Shadow upgrade. The owner only shows the commitment to the upgrade. This upgrade type is mostly useful for fixing critical issues in the production environment.

- Upgrade execution - the Owner or Security council can perform the upgrade with previously scheduled parameters.

- Upgrade with delay. Scheduled operations should elapse the delay period. Both the owner and Security Council can execute this type of upgrade.

- Instant upgrade. Scheduled operations can be executed at any moment. Only the Security Council can perform this type of upgrade.

Only Owner can cancel the upgrade before its execution.

The diagram below outlines the complete journey from the initiation of an operation to its execution.

Upgrade mechanism

Currently, there are three types of upgrades for ZKsync Chains. Normal upgrades (used for new features) are initiated by the Governor (a multisig) and are public for a certain timeframe before they can be applied. Shadow upgrades are similar to normal upgrades, but the data is not known at the moment the upgrade is proposed, but only when executed (they can be executed with the delay, or instantly if approved by the security council). Instant upgrades (used for security issues), on the other hand happen quickly and need to be approved by the Security Council in addition to the Governor. For ZKsync Chains the difference is that upgrades now happen on multiple chains. This is only a problem for shadow upgrades - in this case, the chains have to tightly coordinate to make all the upgrades happen in a short time frame, as the content of the upgrade becomes public once the first chain is upgraded. The actual upgrade process is as follows:

- Prepare Upgrade for all chains:

- The new facets and upgrade contracts have to be deployed,

- The upgrade’ calldata (diamondCut, initCalldata with ProposedUpgrade) is hashed on L1 and the hash is saved.

- Upgrade specific chain

- The upgrade has to be called on the specific chain. The upgrade calldata is passed in as calldata and verified. The protocol version is updated.

- Ideally, the upgrade will be very similar for all chains.

If it is not, a smart contract can calculate the differences.

If this is also not possible, we have to set the

diamondCutfor each chain by hand.

- Freeze not upgraded chains

- After a certain time the chains that are not upgraded are frozen.

ValidatorTimelock

An intermediate smart contract between the validator EOA account and the diamond proxy ZKsync Chain smart contracts. Its primary purpose is to provide a trustless means of delaying batch execution without modifying the main ZKsync Chain contract. ZKsync actively monitors the chain activity and reacts to any suspicious activity by freezing the chain. This allows time for investigation and mitigation before resuming normal operations.

It is a temporary solution to prevent any significant impact of the validator hot key leakage, while the network is in the Alpha stage.

This contract consists of four main functions commitBatchesSharedBridge, proveBatchesSharedBridge,

executeBatchesSharedBridge, and revertBatchesSharedBridge, which can be called only by the validator of the given chain.

When the validator calls commitBatchesSharedBridge, the same calldata will be propagated to the ZKsync contract with the correct chainId

(DiamondProxy through call where it invokes the ExecutorFacet through delegatecall),

and also a timestamp is assigned to these batches to track

the time these batches are committed by the validator to enforce a delay between committing and execution of batches. Then, the

validator can prove the already committed batches regardless of the mentioned timestamp, and again the same calldata (related

to the proveBatches function) will be propagated to the ZKsync contract. After the delay is elapsed, the validator

is allowed to call executeBatches to propagate the same calldata to ZKsync contract.

The owner of the ValidatorTimelock contract is the same as the owner of the Governance contract - Matter Labs multisig.